Get to know the basics

Download our Starter Guide for a clear, simple introduction to Medicare.

Original Medicare health insurance may not be enough.

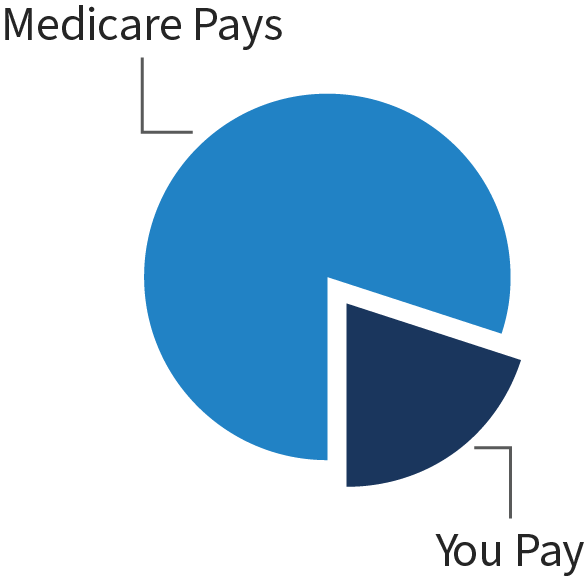

Few people realize that the coverage offered by Original Medicare, known as Parts A and B, is limited to hospital and medical insurance. This covers around 80 percent of your medical costs, which leaves the other 20 percent up to you. An unexpected illness or injury could put your savings at risk. Consider extra coverage, such as a Medicare Advantage plan or Medicare Supplement Insurance (Med Supp) to help with what Original Medicare doesn’t cover.

Prescription drug coverage isn’t automatic.

Original Medicare doesn’t cover prescription drug coverage. Many people choose to join a Medicare Advantage plan that includes Part D prescription drug coverage or sign up for a Medicare Part D prescription drug plan through a private company.

Part C offers comprehensive plans with extras.

Medicare Advantage (Part C) can combine hospital, medical and usually prescription drug coverage in one plan. These plans may also offer dental, vision and other extra benefits. Premiums for these plans vary based on the coverage included, but many plans offer $0 premiums.

Med Supp plans can be expensive.

Med Supp plans are one way to help reduce your out-of-pocket expenses not covered by Original Medicare. However, they can be expensive. The monthly premiums vary depending on age, location, health status and many other factors. It’s also worth noting that supplements don’t typically offer prescription drug, hearing, vision or dental coverage.

Having a good primary care physician (PCP) is important.

As you age, it becomes more important to have a trusted doctor to help maintain your health or manage chronic conditions. If you already have a trusted PCP and have established a solid relationship with them, you’ll want to make sure they accept the insurance plan you choose. If you think you might prefer a different PCP, use this opportunity to make a change.

Not all plans offer out-of-network coverage.

When choosing how to receive your Medicare benefits, it’s important to consider your lifestyle. Medicare plans cover emergency or urgent care. However, if you spend substantial amounts of time away from home and have specialists that you need to see on a regular basis while out of town, you’ll want to make sure the plan you choose covers those costs.

Medicare isn’t premium free.

Part B of Original Medicare has a premium that varies depending on your income. In most cases, the premium amount is deducted directly from your Social Security check. In addition, this premium doesn’t cover prescription drugs. When signing up for Medicare benefits, look into exactly how much all your premiums will be and pick the right option for your budget.

Your employer plan may not be the best option if you’re working past 65.

If you’re not retiring at 65 it may seem simple to just keep your employer-based coverage. Compare your costs, coverage and flexibility of your employer plan vs. switching to a Medicare plan.

Sign up for Medicare on time.

When you turn 65 or otherwise become eligible for Medicare, enrollment windows open, but some of these windows close quickly. If you wait too long, you may have fewer choices or face penalties and higher premiums. The initial enrollment period is a seven-month window that begins three months before your 65th birthday month and ends three months after your birthday month. You can enroll in Parts A, B, C and/or D during that time.

Initial Enrollment Period (IEP)

Sign up for Medicare for the first time.

Long-term care isn’t covered.

While Medicare covers 80 percent of healthcare expenses, it generally doesn’t cover long-term care. Under certain conditions, Medicare will pay for a skilled nursing facility or home healthcare, but Medicare doesn’t cover services that help you with daily activities such as dressing and bathing. With Original Medicare alone, those costs must be paid out of pocket. If you have concerns about these potential costs, you might want to investigate purchasing a long-term care insurance policy.