Get to know the basics

Download our Starter Guide for a clear, simple introduction to Medicare.

Navigating Medicare can feel overwhelming, but we’re here to help with clear answers to common questions—including Medicare basics, eligibility, enrollment, coverage choices and tips for unique situations. We’ve also included helpful resources and contacts so you can confidently make the best choices for your health coverage needs.

Medicare is a government health insurance program designed mostly for older adults to help pay for health-related services. It includes several parts and coverage options.

To be eligible for Medicare, you must be a permanent U.S. resident or legal citizen living in the U.S. for five years in a row.

Plus, you’ll need to meet one of the following requirements:

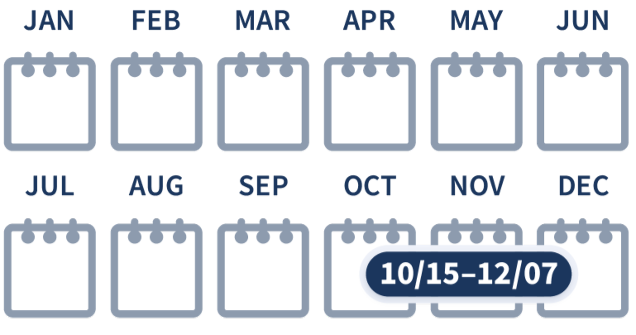

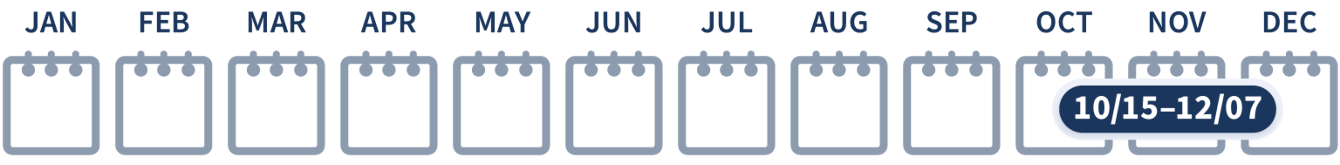

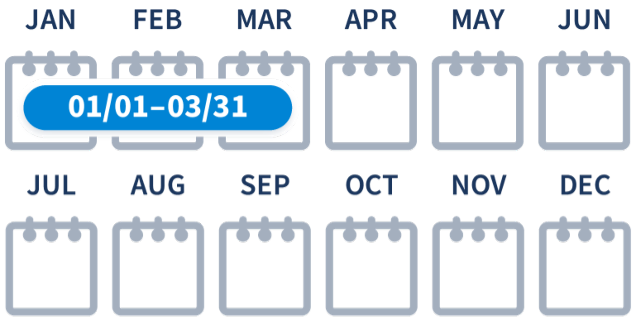

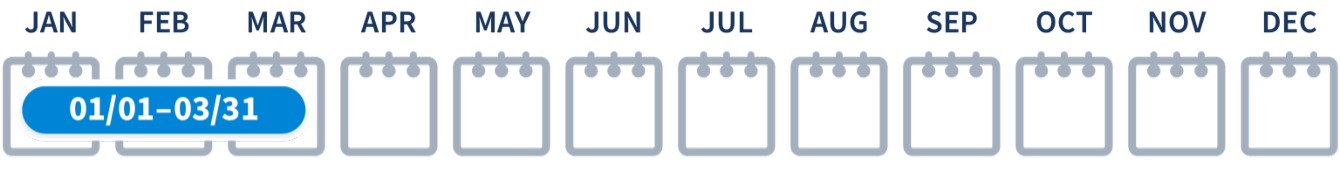

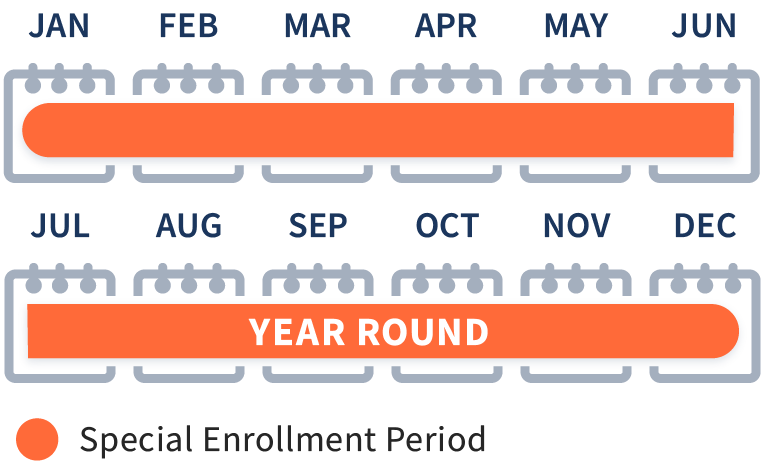

Sign up for Medicare for the first time.

Switch, drop or join a different Medicare plan.*

Make a one-time election to change your Medicare Advantage plan.*

Enroll in a Medicare plan if you qualify.**

* You can also switch to Original Medicare as well as add or drop Part D coverage. The MA OEP is only available if you’re already in a Medicare Advantage plan.

** Examples of when you’d qualify include a recent move, leaving employer or union coverage, or having a 5-star-rated plan available in your area.

![]()

![]()

![]()

To help with your research on each option, check out the following articles.

Navigating Medicare: You Have Options

Research to Find Your Ideal Medicare Plan

Compare Your Options: Med Supp and Medicare Advantage

How to Pick the Best Medicare Health Insurance Plan in Your Area

No, you won’t lose your Original Medicare (hospital and medical) coverage if you join that type of plan. They work in combination with Original Medicare.

Medicare Advantage provides extra benefits, like dental, vision, hearing and more. It helps control Original Medicare costs with fixed copays or coinsurance, has a maximum out-of-pocket limit, and most plans don’t have deductibles.

Med Supp plans help manage healthcare expenses by covering additional costs like copays, coinsurance and deductibles.

Essence Healthcare

Our licensed advisors are ready to answer your questions at any stage of your journey.

Toll-free: 1-866-536-1052 (TTY: 711)

EssenceHealthcare.com

Medicare

Helpline: 1-800-MEDICARE (TTY: 1-877-486-2048)

24 hours a day, seven days a week

Medicare.gov

Social Security Administration

Toll-free: 1-800-772-1213 (TTY: 1-800-325-0778)

8 a.m. to 7 p.m., Monday through Friday

SSA.gov

State Health Insurance Assistance Program (SHIP)

ShipHelp.org

Use the SHIP locator to find the contact information for your state.

Railroad Retirement Board

Toll-free: 1-877-772-5772 (TTY: 1-312-751-4701)

9 a.m. to 3 p.m., Monday through Friday

RRB.gov

Low-Income Subsidy (LIS)

Extra Help with prescription drug costs

SSA.gov/Medicare/Part-D-Extra-Help

Start with this checklist and then review these articles to get familiar with things to consider, Social Security and more.

Start with this checklist and then review these articles to learn about delaying retirement, Social Security and more.

This article explains eligibility and the specific details of Medicare Part A and Part B coverage. It also has additional resources to help with your research.

Our list of things to consider will help you get started in assisting a loved one explore Medicare options. You may also find the articles below are useful resources for your research.

Original Medicare (Parts A and B) doesn’t pay for long-term care like nursing homes, or for regular dental visits, glasses, or hearing aids.

You can buy extra insurance to cover long-term care or other health services not covered by Original Medicare.

Medicare Advantage plans (Part C), often include coverage for dental, vision, hearing, fitness and more.

A deductible is the amount you pay for covered health-related services (doctor visits and prescriptions) before your insurance plan starts to pay.

The maximum out-of-pocket (MOOP) amount/limit is the most you have to pay for covered health-related services in a plan year. Once you hit the limit, your health insurance plan will pay for everything the remainder of the year.