Get to know the basics

Download our Starter Guide for a clear, simple introduction to Medicare.

Navigating Medicare for the first time can feel overwhelming, with so many coverage choices, costs and deadlines to consider. Getting familiar with Medicare and what to watch out for will help you make more informed decisions. Let’s review five key areas to ensure you’ll have coverage that works for you.

Don’t Forget About Premiums

Medicare includes several details that can be confusing, starting with how you pay for it. Since almost everyone qualifies for Medicare Part A with no cost, many assume that Medicare is premium free. However, Part B of Original Medicare has set premiums that can vary yearly.

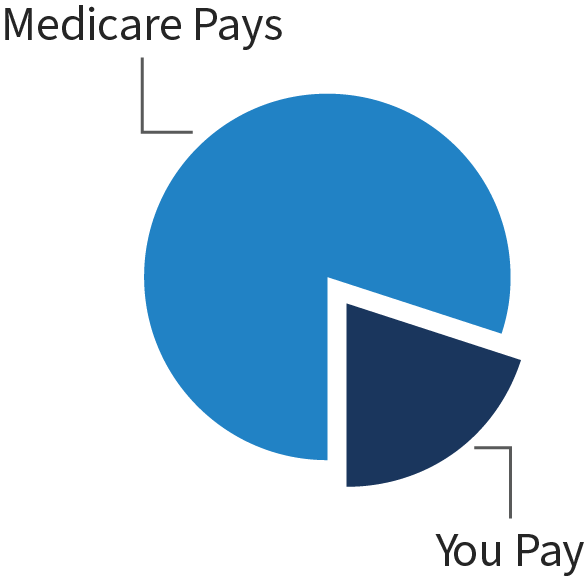

Typically, the premium for Part B is deducted directly from your Social Security check. It’s important to note that this premium only covers about 80 percent of your medical and hospital costs, and it doesn’t cover prescription drugs.

It’s common for Medicare beneficiaries to seek additional coverage. For example, you may purchase Medicare Supplement Insurance (Med Supp), as well as a Part D prescription drug plan to be protected in case of illness or injury. Depending on the coverage you choose, you could be paying a premium for Part B, Part D drug coverage and a separate Med Supp plan to cover the 20 percent Original Medicare doesn’t cover. These premiums can add up quickly, so be sure to examine your options carefully and find a plan that works for you.

Many Medicare Advantage plans (Part C) are premium free and include benefits beyond what Original Medicare provides. You’ll have to continue to pay your Part B premium.

Get Familiar with Coverage

It may come as a surprise to learn Original Medicare doesn’t cover everything. Medicare doesn’t cover certain health services like long-term care, routine dental visits, glasses or hearing aids. If you want this type of coverage, you have options.

You can buy extra insurance to cover long-term care or other health services not covered by Original Medicare.

You can choose a Medicare Advantage plan to get extra benefits. They’re offered by private companies and have been approved by Medicare. Medicare pays these companies to cover the members’ Medicare benefits. Medicare Advantage plans include Medicare Parts A, B and usually D, plus extra benefits like dental, vision, hearing coverage, fitness club memberships and more.

Research Medicare Star Ratings

Star ratings are a gift to the consumer. It’s like having a review from Consumer Reports for Medicare plans. The ratings offer an unbiased evaluation of the various Medicare options available to you. Plans are evaluated each year by the Centers for Medicare & Medicaid Services (CMS), based on the following criteria:

Every year, Medicare evaluates plans based on a 5-star rating system. A 1-star rating is “poor” and a 5-star rating is “excellent.” The rating for each plan can change from year to year, so check Medicare.gov for current results.

Know Your Budget

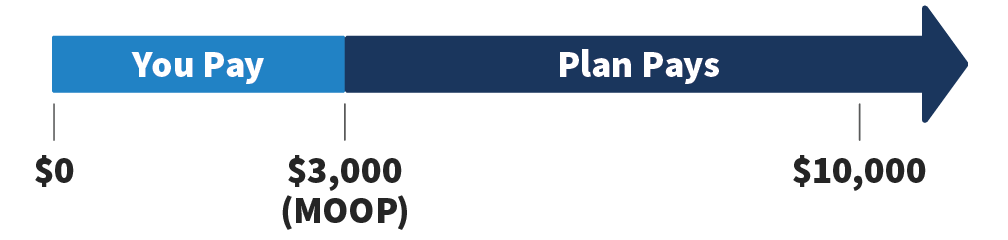

When choosing a plan, it’s important to note how much you’ll have to pay out of your own pocket. A maximum out-of-pocket limit (MOOP) means that you’ll be protected from having to pay anything beyond the specified amount outlined in your plan. For example, a plan might have a maximum out-of-pocket spending limit of $3,000. That means that no matter the injury, sickness or how long you need care, you’ll never spend more than $3,000 in a plan year on covered services.

Original Medicare and most Med Supp plans don’t have a MOOP. Medicare Advantage plans are required by law to include it. If you feel a Medicare Advantage plan is the right option for you, make sure it has a MOOP that works with your budget.

Avoid Penalties

If you wait too long to enroll in Medicare, you might have fewer choices or face penalties and higher premiums. Your monthly premium for Part B may go up 10 percent for each full 12-month period that you could’ve had Part B but didn’t sign up for it. You’ll have to pay this penalty for as long as you have Part B.

Most people don’t have to pay a premium for Part A, but if you do, signing up late can result in a penalty. You’ll have to pay your normal Part A premium plus 10 percent, and you’ll have to pay this penalty for twice the number of years you didn’t enroll.

If you decide to enroll in Part D after first becoming eligible, you may have to pay extra as well.

Initial Enrollment Period (IEP)

Sign up for Medicare for the first time.

You have several resources available to help you understand all the details of Medicare (including our Medicare Learning Center). Use this information to help you get ready to enroll and make the best decision for you.